ADVANCING CULTURE ADVANCING ARTISTS ADVANCING COMMUNITY

ADVANCING

CULTURE

ARTISTS

COMMUNITY

WHO WE ARE

Preserving the Heritage and Culture of Latino and Indigenous Peoples

Founded in 1975, Xico is one of oldest ethnic arts organizations in the United States and is a leading organization promoting Latino and Indigenous culture through art and community engagement. We have a rich network of artists, nearly 50 years of experience, and together with our partners, an active community voice.

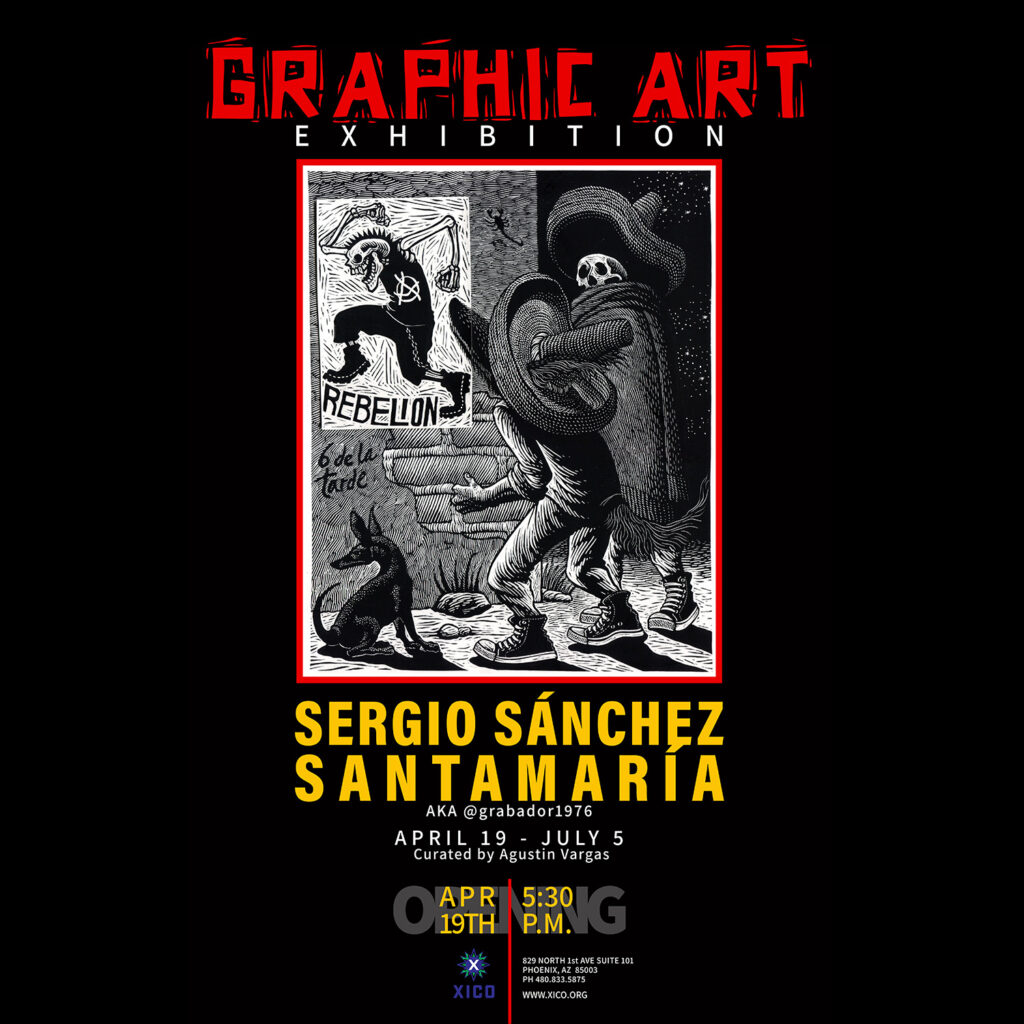

Graphic Art Exhibition: Sergio Sánchez Santamaría

Come witness the magic in Xico’s latest curated exhibition featuring master printer Sergio Sánchez Santamaría. Thirty elaborate prints will unveil a deeper look into the culture, traditions and symbols that yell out “Rebelion!”

He is a lithographer, master printer, illustrator of album covers, and label designer for mezcal and tequila distillates. He is a visual artist specializing in graphic art. This is only part of his work, this exhibition focuses mostly on linoleum relief prints and some lithographs.

Santamaría says, “This time I made a selection of pieces that had not been seen together. The themes that are constant in my work are Mexican heritage, the contemporary world contrasting the pre-Hispanic past with modernity. This is not social criticism, nor are they hollow pre-Hispanic concepts, rather they are visual allegories existing. Sharp observations of how society moves where injustices and social clamors are observed. My work travels from the anecdote to the uneasiness about the current world we live in, where humanity is losing sensitivity.”

About Xico

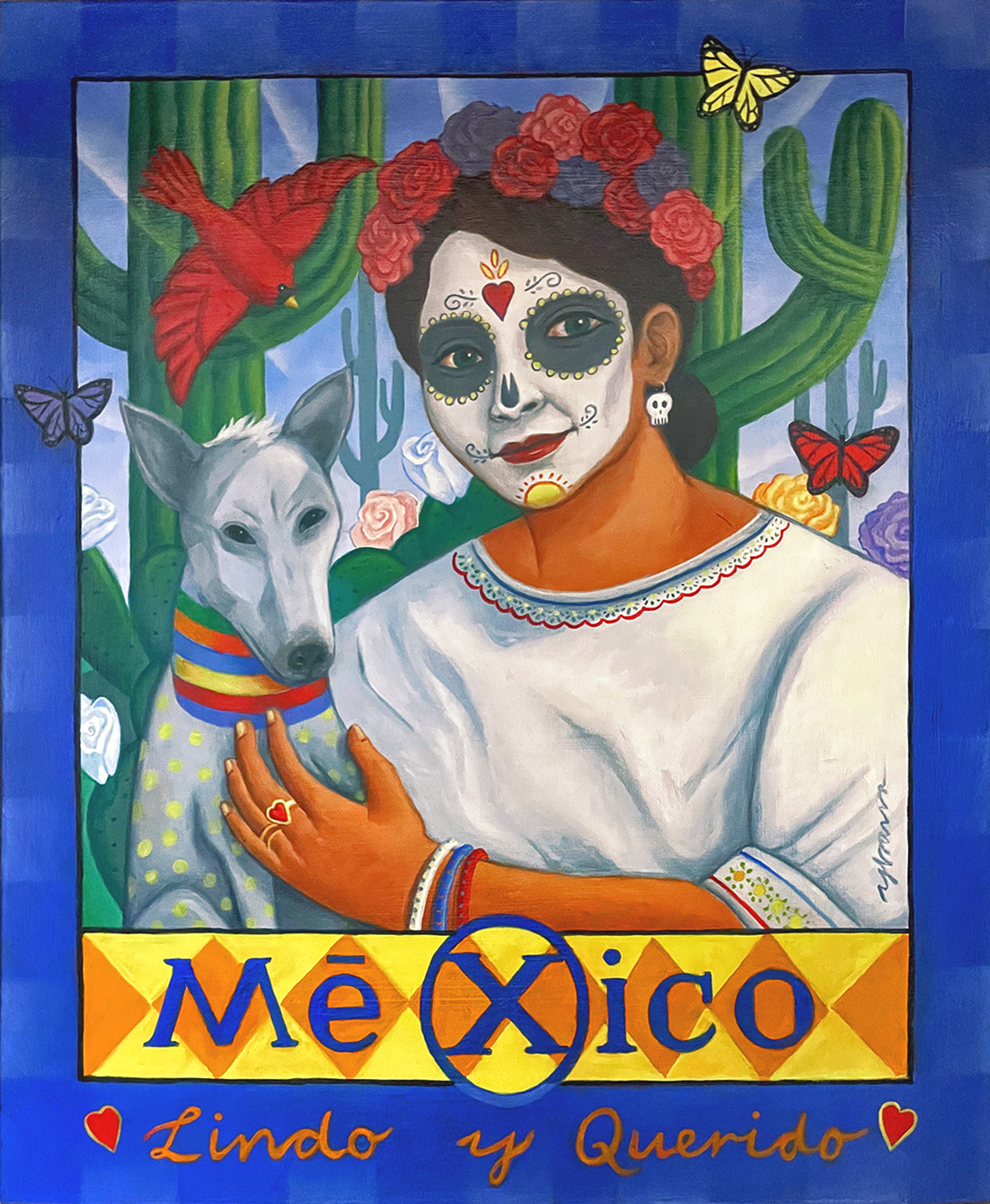

36th Annual Dinner & Art Auction

MēXico - Lindo y Querido

On behalf of the Xico board of directors and staff, we extend our deepest gratitude to those who attended and supported our 36th Annual Dinner & Art Auction on February 24, 2024.

The success of the night far surpassed our expectations, with over 550 attendees and an astounding fundraising achievement of over $446,600 – marking our most successful event to date. The generous purchase of art has played a pivotal role in advancing Xico’s mission to promote and sustain Latino and Indigenous culture through art, as well as to serve and elevate Latino and Indigenous artists.

We eagerly anticipate the pleasure of welcoming you once again in February 2025, as we celebrate Xico’s 50th Anniversary and honor Carmen and Zarco Guerrero as our 2025 Virginia E. Cárdenas Arts Advocate Award Recipients. Your commitment to advancing culture, artists, and community is truly commendable, and we are deeply grateful for your ongoing partnership.

ENHANCE YOUR SKILLS

Xico Classes

At Xico, we are passionate about teaching art classes because we believe that art education should be accessible to everyone, regardless of background or skill level. We provide a welcoming and supportive environment where students can explore their creativity and develop their artistic abilities. Sign up for a class today and begin your creative journey!